- 17 February 2022

- By: IwayServices

- Blog

What is an EDI e-Invoice ?

Invoices transmitted by Electronic Data Interchange (EDI – EDI e-Invoice) are in the form of a structured message, according to an agreed standard, allowing for reading by computer and which can be processed automatically.

They are de facto original invoices.

Electronic data interchange makes it possible to secure the transmission of electronic invoices autonomously, it alone guarantees the authenticity of their origin, the integrity of their content and their legibility.

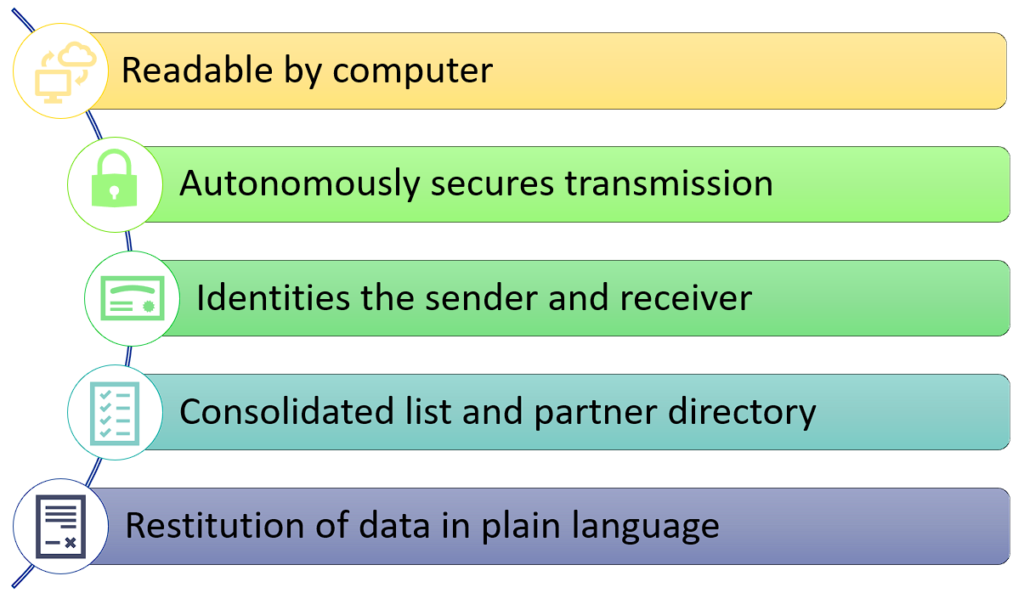

For this purpose, the remote transmission system used must comply with the following conditions:

- The identity of the message sent and received.

- Creation of a summary list and a file of partners.

- Data archiving (see article BOI-CF-COM-10-10-30-10).

- Restitution of data in plain language (see BOI-CF-COM-10-10-30-10 as well).

NB : The summary list and the directory of partners are essential features of EDI.

The invoice message must contain at least the mandatory information.

The software must make mandatory the information provided for by the regulations.

The use of stable codes designating, for example, products or persons is possible, if the coding is automatically deciphered using a correspondence table, whose modification history is preserved, integrated into the restitution function.

The exchange of dematerialized invoices can take place in a heterogeneous environment (transmitting and receiving stations of different types)

The invoice must not be altered in any way after it has been constituted, issued by the supplier and archived.

The company that issues or receives invoices must ensure that it is kept and kept in electronic form for the period set by Article L. 102 B of the LPF which is 10 years for commercial invoices.

Summary list

The EDI system shall be able to reproduce a sequential summary list of all messages sent and received and their possible anomalies.

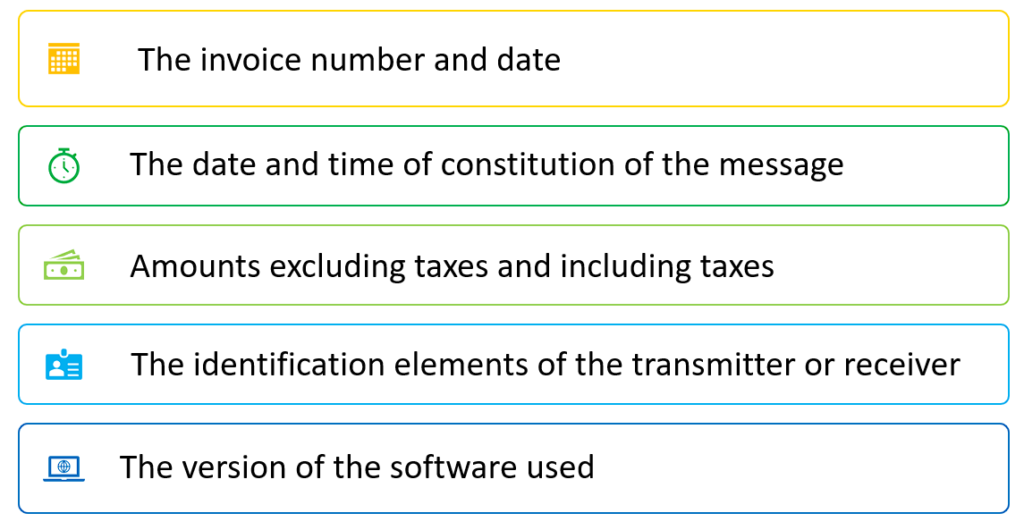

This list must include at least the following information:

- The number and date of the invoice.

- The date and time of creation of the message.

- The amounts excluding taxes and all taxes of the transaction, as well as the currency code when the invoice is not denominated in euros.

- The identification elements of the transmitter or receiver given by the teletransmission system (code, name or company name, SIRET or SIREN number, address, status of supplier or customer).

- The version of the software used.

The file must be created and populated as messages are sent or received and must not be editable.

Taxable persons who do not have their own dematerialisation platform may use a service provider

The guarantees of a dematerialization system ?

The service providers must guarantee that their system of dematerialization and archiving of invoices complies with all the conditions prescribed by Articles 96 G and 96 H of Annex III to the CGI.

It must be possible to reproduce it on screen or on a computer medium to be carried out selectively on the basis of the mandatory information which the list must contain.

Companies, suppliers or customers, must constitute a file of partners with whom they exchange dematerialized invoices. This file must be fed automatically by the remote transmission system

This file must include, for each partner, the following information: name or denomination and address, quality of transmitter and / or receiver, date of entry into the dematerialization phase with the partner and date of exit.

When the teletransmission system is accompanied by a summary list and a file of partners and complies with all the specifications provided for by the CGI, the implementation of controls establishing a reliable audit trail is not necessary for the purpose of securing invoices.

Although the teletransmission system does not guarantee the authenticity of the origin, the integrity of the content and the legibility of the invoices transmitted, the taxable person is bound by

- Or to put in place controls establishing a reliable audit trail.

- Either to use an electronic signature (or server stamp) “qualified”.

Contact IwayServices Experts

IwayServices, an EDI and SAP EDI consulting firm, can assist you in all stages of invoice dematerialization, regardless of the format. Our experts will provide you with the right answers and solutions to meet your needs.

Sources :