- 9 February 2022

- By: IwayServices

- Blog

An update on the regulation of electronic invoices

What is an invoice ?

In this article, we will focus on the generalities, regulations that govern electronic invoices.

The invoice is an official document that is at the crossroads of several regulations, which sometimes leaves room for several interpretations that can contradict each other.

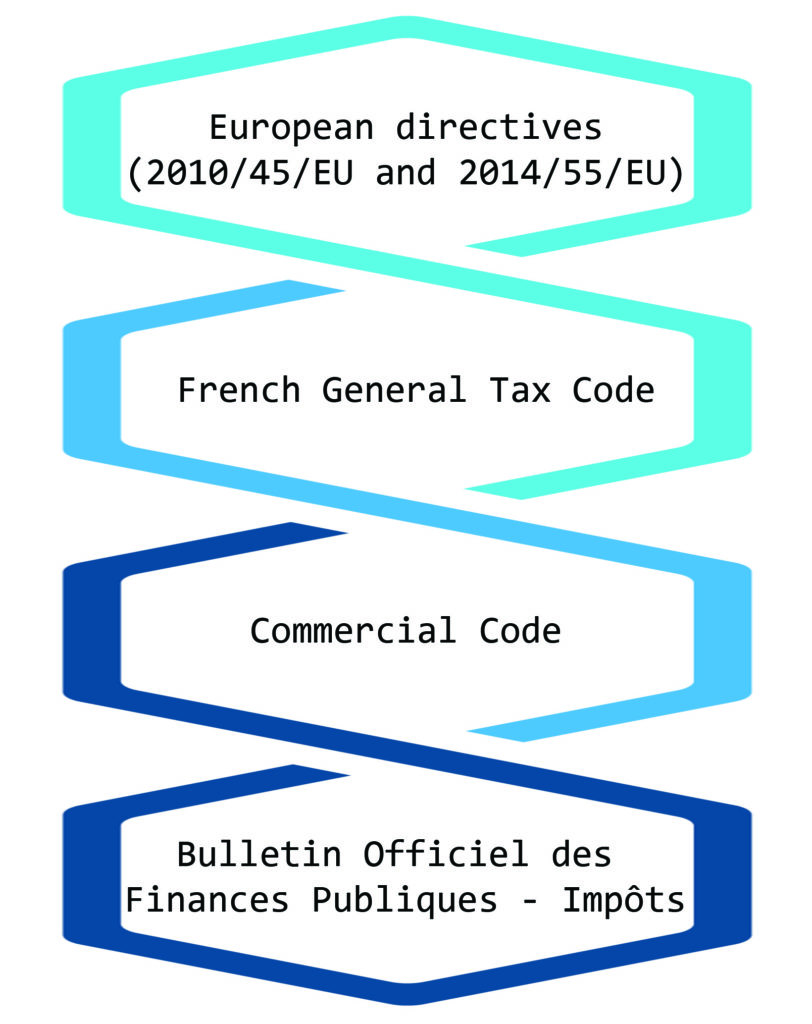

Although each country remains sovereign in the writing of tax regulations, it is the European directives (2010/45/EU and 2014/55/EU) that inspire the French General Tax Code and the Commercial Code , especially at the level of electronic invoicing.

Invoices serve several purposes. It is a legal proof of the service rendered, or of the goods sold, and establishes the seller’s right to claim payment. It is an obligation to invoice any professional activity.

It also holds the details of the sale and serves as accounting evidence for the preparation of the annual accounts.

Contains information on the VAT applicable and of any deductions made.

And of course, it allows the tax administration to exercise its right of verification.

The authenticity of the origin, the integrity of the content and the legibility of the invoice

An important sentence in Article 289 of the CGI says:

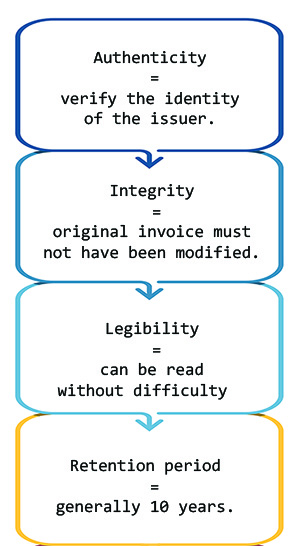

“The authenticity of the origin, the integrity of the content and the legibility of the invoice must be ensured from the moment it is issued until the end of its retention period.»

“Authenticity of origin” means that it is up to the supplier AND the customer to verify the identity of the issuer.

The supplier has either :

- Issued the invoice himself

- The invoice was issued by a trusted third party (EDI service provider, accountant, etc.) .

“Integrity of the content” means that the entirety, mandatory or not, of the original invoice must not have been modified.

“Legibility of the invoice” means that it can be read without difficulty by the user and by the administration, on paper or on screen.

The retention period varies according to certain specific cases, but is generally 10 years.

Mandatory information on an invoice

The obligations and invoicing methods apply regardless of the medium (paper or electronic) or the means of transmission of invoices. (CGI Article 242h A):

- Date of issue of the invoice

- Invoice numbering

- Date of sale or provision of services

- Identity of the buyer

- Identity of the seller or service provider

- Purchase Order Number

- Individual VAT identification number of the seller and the professional customer

- Description of the product or service

- Detailed breakdown of each service and product provided

- List price

- Possible price increase

- Legally applicable VAT rate

- Total amount of corresponding VAT

- Price reduction

- Total amount to be paid excluding tax (HT) and all taxes included (TTC)

- Payment date or deadline

- Late Payment Penalty Rates

- Mention of the flat-rate compensation of 40 €

Acceptation de la procédure de transmission électronique

Today, the transmission and provision of electronic invoices is subject to acceptance by the recipient, either via an interchange contract between companies or via a service provider. Acceptance can also be done tacitly, for example, when the customer pays an invoice received.

This changes with Ordinance No. 2021-1190 of 15 September 2021 where the electronic invoicing obligations will be imposed according to a progressive schedule:

- From 1 July 2024, upon receipt, to all taxable persons,

- From 1 July 2024, in transmission, to large companies,

- From 1 January 2025 to mid-caps,

- From 1 January 2026 to small and medium-sized enterprises and micro-enterprises.

The deployment of e-reporting obligations will follow the same schedule.

Contact IwayServices Experts

IwayServices, an EDI and SAP EDI consulting firm, can assist you in all stages of invoice dematerialization, regardless of the format. Our experts will provide you with the right answers and solutions to meet your needs.